Working Papers

Global Financial Chains

with Raoul Minetti, Oren Ziv

Presented at 2024 Financial Intermediation Workshop Bank of Italy – EIEF, NBER SI 2024, Luiss Business School, 2024 ECB-FRB-FRBNY Global Research Forum on International Macroeconomics and Finance

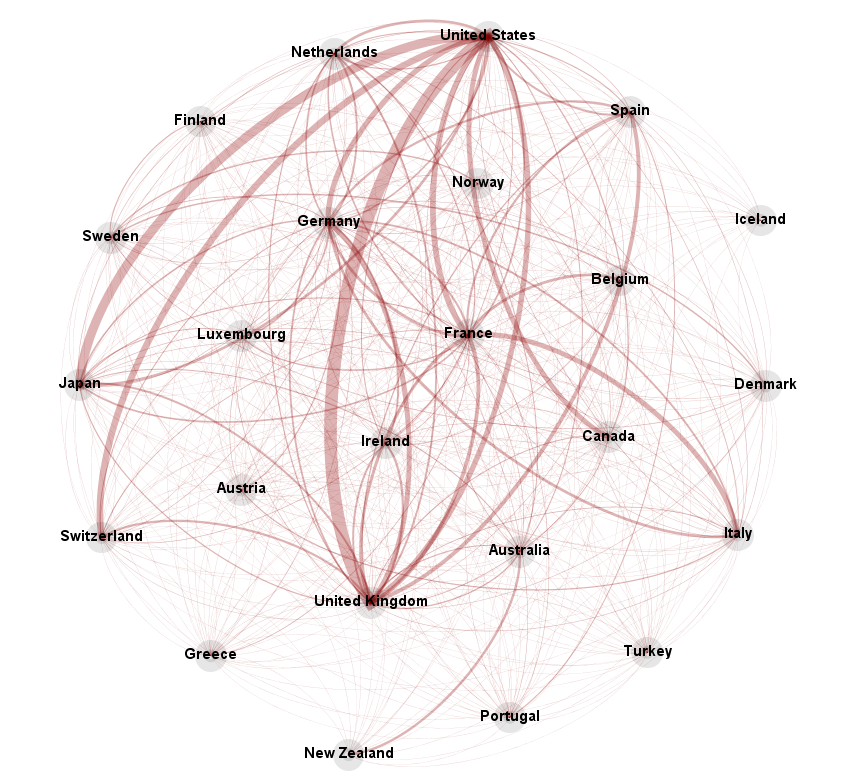

The use of global financial hubs and tax havens to move capital internationally obfuscates ultimate international investment positions in available data. We provide a partial equilibrium network model of global capital positions where capital can be sent indirectly from origin to destination through one or multiple third countries (chains) in a manner which minimizes transaction costs. The model can be embedded in common classes of international finance general equilibrium models. We use the model to microfound the algorithmic restatement procedure in Coppola, Maggiori, Neiman, and Schreger (2021) and obtain conditions under which the empirical chains of asset holdings recover the ultimate underlying bilateral positions. We then estimate our model relaxing those conditions. We generate an enlarged matrix of bilateral restatements as well as a cost matrix that underpins these holdings. Our findings confirm the role of tax havens in international financial transactions and augment the recharacterization of China’s net positive position. Our results uncover a substantial intermediation role for the United States and the United Kingdom and allows us to identify the ultimate owners of investments ostensibly originating in tax haven countries. The implicit cost matrix we recover exhibits a strong gravity relationship. Our estimation produces four data products: a restated matrix of global capital positions, a matrix of bilateral transfer costs, a matrix of bilateral network transfer costs, and an enlarged version of the IMF Coordinated Portfolio Investment Survey (CPIS).

Fragmentation and the future of GVCs

with Francesco Paolo Conteduca, Michele Mancini, Simona Giglioli, Alessandro Borin, Enrica Di Stefano, Maria Grazia Attinasi, Lukas Boeckelmann, and Baptiste Meunier

Recent shocks and policy trends – including the weaponization of supply chains and measures to enhance national security and protect strategic sectors – have triggered a deep reorganization of international trade, particularly along geopolitical fault lines. This paper assesses how escalating trade restrictions between a Western US-centric bloc and an Eastern China-centric bloc — particularly those targeting products with a high risk of weaponization — affect supply chains, trade dependencies, and economic activity. To capture ex ante the impact of these targeted trade restrictions within a general equilibrium framework, we construct customized input-output tables that reflect the selective nature of these interventions. We find that trade fragmentation would produce significant global welfare and trade losses, despite the targeted shock. We then provide a detailed analysis of how global value chains and trade dependencies would adjust across countries and sectors in response to such shocks. While overall trade integration would be broadly unaffected, global value chains would become more regionalized, complex, and harder to monitor. Neutral countries would play a growing role into GVCs, especially as connectors between rival blocs. While direct dependencies would decline, indirect dependencies would be stronger.

Does JIT production change the network structure of GVCs? Evidence from Italian firms

with Simona Giglioli

Publications

Banking Complexity in the Global Economy (2025) Journal of International Economics [paper] [wp]

with Raoul Minetti, Oren Ziv

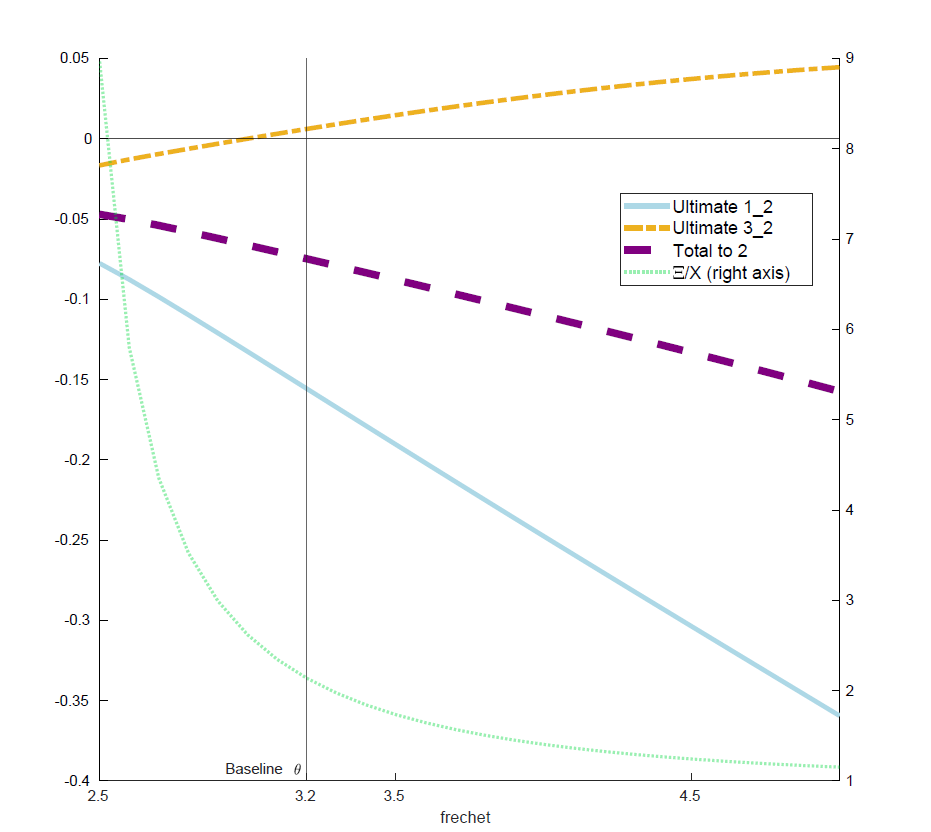

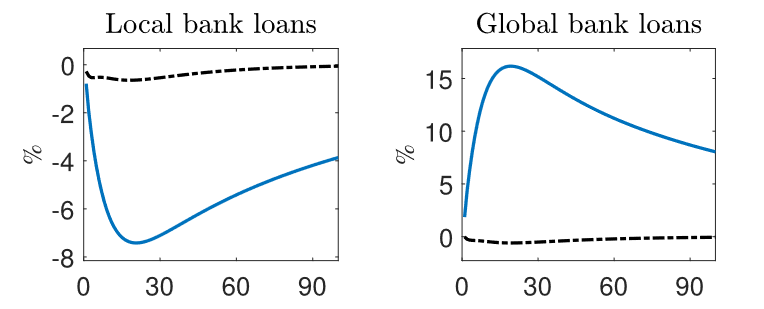

International lending flows are often intermediated through banking hubs and complex multi-national routing. We develop a dynamic stochastic general equilibrium model where global banks choose the path of direct or indirect lending through partner institutions in multiple countries. We show how conflating locational loan flows with ultimate lending biases results both by attributing ultimate lending to banking hubs, and by missing ultimate lending that occurs indirectly via third countries. We next study the effects of global banking complexity. Indirect lending allows countries to bypass shocked lending routes via alternative countries; however, it dilutes their ability to diversify sources of funds after shocks. The quantitative analysis reveals that banking complexity can exacerbate credit and output instability when countries feature heterogeneous banking efficiency.

Recessions and Recoveries. Multinational Banks in the Business Cycle (2021) Journal of Monetary Economics [paper]

with Qingqing Cao, Raoul Minetti, Maria Pia Olivero

How does the expansion of multinational banks influence the business cycle of host countries? We study an economy where multinational banks can transfer liquidity across borders through internal capital markets but are hindered in their allocation of liquidity by limited knowledge of local firms’ assets. We find that, following domestic banking shocks, multinational banks moderate the depth of the contraction but slow down the recovery. A calibration to Polish data suggests that multinational banks reduce the average depth of recessions by about 5% but increase their duration by 10%. The predictions are broadly consistent with evidence from a large panel of countries.

Discussions

“Trade Intermediation and Resilience in Global Sourcing”, by Perelló

2024 BdI, ECB, WB workshop on “Trade, value chains and financial linkages in the global economy”

“The Ripple Effect: Supply Chain Reconfigurations and Cross-border Credit Dynamics”, by Correa, Fabiani, Ossandon, Sarmiento

2024 10th Annual Banking Research Network Workshop

“A Sufficient Statistics Approach for Endogenous Production Networks: Theory and Evidence from Ukraine’s War”, by Korovkin, Makarin, Miyauchi

2023 BdI, ECB, WB workshop on “Trade, value chains and financial linkages in the global economy”